Overview

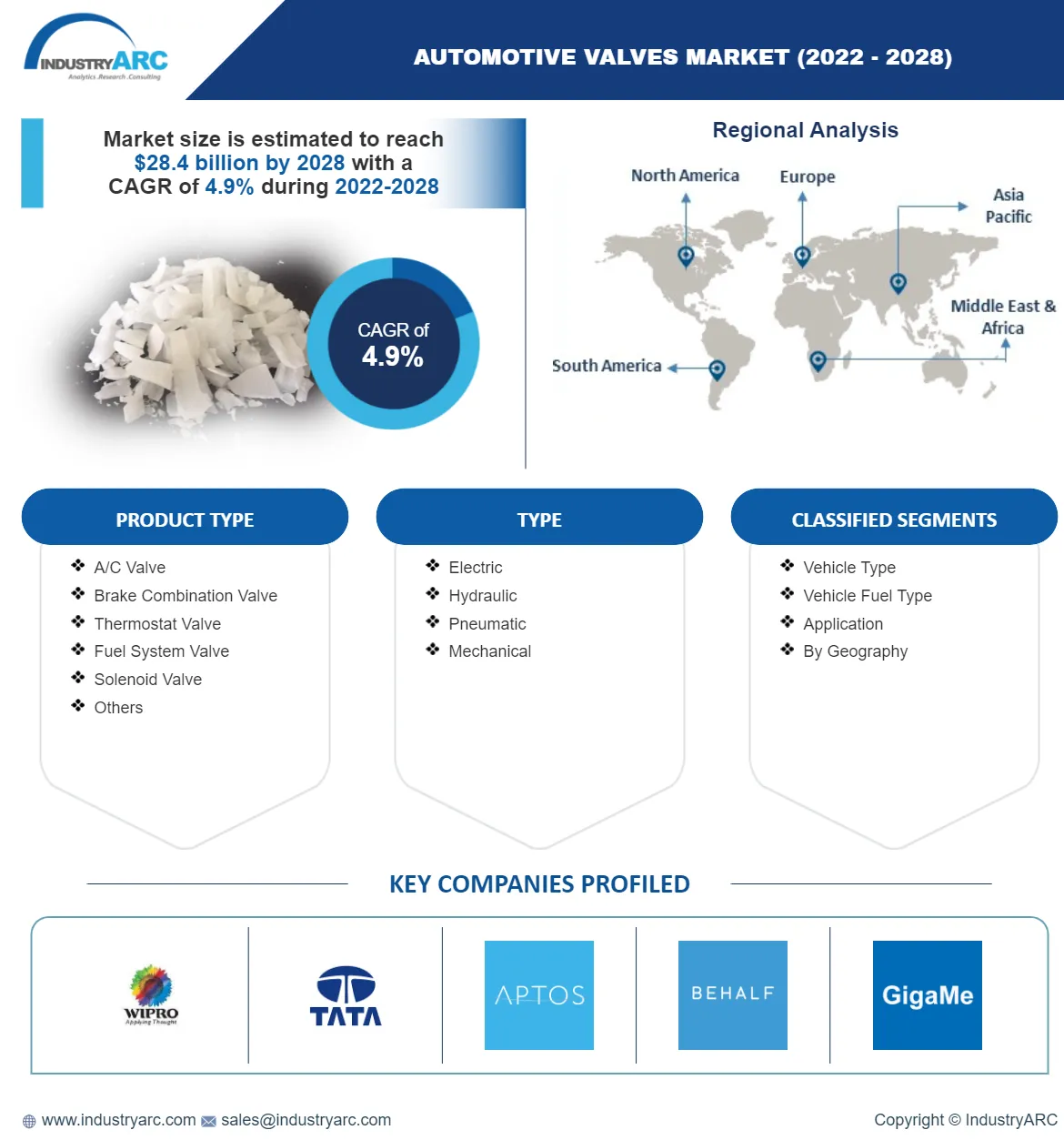

Automotive Valve market is expected to reach $38.5 billion by 2025 at a CAGR of 5.2% during the forecast period 2020-2025. Increasing vehicle production in emerging markets and rising demand for electric cars in developed markets are analyzed to drive the market in the forecast period. Automotive manufacturers are developing advanced based automotive valves according to the requirements of the vehicles. Moreover implementation of the stringent government regulations owing to fuel efficiency is further set to escalate the market growth rate. Hence these advancements are analyzed to drive the market in the forecast period 2020-2025.

Report Coverage

The report: “Automotive Valve Market – Forecast (2020-2025)”, by IndustryARC covers an in-depth analysis of the following segments of the Automotive Valve market

By Product Type: A/C Valve, Brake Combination Valve, Thermostat Valve, Fuel System Valve, Solenoid Valve, Others

By Type: Electric, Hydraulic, Pneumatic, Mechanical, Others

By Vehicle Type: Passenger Car, Light Commercial Vehicle, Heavy Commercial Vehicle, Battery Electric Vehicle, Plug-In Hybrid Electric Vehicle, Hybrid Electric Vehicle

By Application: Engine System, HVAC System, Brake System, SCR System, anti-lock braking system, steering locks, fuel valve control, Others

By Geography: North America (U.S, Canada, Mexico), South America(Brazil, Argentina and others), Europe(Germany, UK, France, Italy, Spain, Russia and Others), APAC(China, Japan India, SK, Aus and Others), and RoW (Middle east and Africa)

Key Takeaways

- APAC dominated the automotive valves market by market share of 35.5% followed by North America and Europe. In these regions factors such as rising automotive production and increasing installation of upgraded technology features such as Anti-lock braking system (ABS), start-stop systems, and automatic transmission are some factors expected to support valve market.

- Solenoid valves are growing at a highest CAGR of 7.5% in the forecast period, owing to their usage in standard vehicle applications such as motor starter, steering locking system, and fuel valve control.

- Government regulations and standards such as Corporate Average Fuel Economy (CAFE) and others have mandated an increase in fuel efficiency of vehicles, which in turn is driving the global automotive valve market.

- Automotive Valve top 10 companies include Borgwarner Inc., Continental AG, Delphi Automotive PLC, Denso Corporation, Eaton Corporation PLC, Federal Mogul, Johnson Electric Group, Robert Bosch GmbH, Valeo S.A., G&S Valves among others.

By Product Type- Segment Analysis

Solenoid valves are growing at a highest CAGR of 7.5% in the forecast period. Automotive solenoid valve has significant usage in standard vehicle applications such as motor starter, steering locking system, and fuel valve control. Additionally, a solenoid valve has advantages over other kinds of valves, as it is fast in operation and is suitable for electronic functions such as door locking system and anti-lock braking system. Several companies have been investing heavily for these valves. In 2020, Rheinmetall Automotive booked a $32.5 M contract for solenoid valves for exhaust-gas turbochargers with Kia motors for global engine range. Moreover advancements in these valves are also analysed to drive the market. For instance, Rotex Company showcased its range of Hydrocarbon Dosing Solenoid Valve/Modules for DPF regeneration system and AMT Control Solenoid Valve Modules for the commercial vehicle segment. In addition it also displayed new Solenoid Valves for applications like Advanced Fuel injection/metering system, Power Take-off systems, coolant and air delivery management and innovative control valves for comfort seating systems. Hence these advancements are analysed to drive the market in the forecast period 2020-2025.

By Vehicle Type- Segment Analysis

Automotive Valves in Hybrid Electric Vehicles segment is growing at a CAGR of 7.8% in the forecast period. Automotive Valves in hybrid vehicles are used to deal with the vapor emissions challenges and in other safety systems. Several Companies have been investing heavily for the advancements in these valves. For instance, Eaton has Introduced Electronic Fuel Vapor Management Valves for Hybrid-Electric Vehicles that Increase Safety and Reduce Emissions. Moreover increased investments in production of hybrid electric vehicles are analyzed to drive the market. In 2019, Volkswagen has committed to produce more than 6 million hybrid vehicles by 2029. Similarly several other manufacturers such as Ford, GM and others are also investing heavily for the production of these vehicles. Hence these investments are analyzed to drive the market in the forecast period 2020-2025.

By Geography - Segment Analysis

APAC dominated the automotive valves market by market share of 35.5%, followed by North America and Europe. The economy of APAC is majorly influenced by the major countries such as China and India. In these regions factors such as rising automotive production and increasing installation of upgraded technology features such as Anti-lock braking system (ABS), start-stop systems, and automatic transmission are some factors expected to support valve market. In addition, increasing demand for fuel-efficient vehicles and stringent emission norms are pushing manufacturers to invest in automotive valves. In 2019, Ford has committed to invest more than $1 billion for automotive production. South Korea's automobile manufacturer Kia Motors has invested around US$1.1 billion to build its first manufacturing plant in India and the facility is expected produce up to approximately 300,000 units each year. Similarly Volkswagen has committed to invest more than $2 billion for the production of vehicles with advanced features such as ABS, Start-stop systems and so on. Hence these investments and increased production rate of automotive vehicles are analyzed to bring significant opportunities for Automotive valves in the forecast period 2020-2025.

Drivers – Automotive Valve Market

- Rise in demand for Electric Vehicles

The electric car market has witnessed rapid evolution with the ongoing developments in automotive sector and favorable government policies and support in terms of subsidies and grants, tax rebates. Major manufacturers such as General Motors, Toyota, and BMW plan to release a potential of 400 models and estimated global sales of 25 million by 2025. In 2018, Ford Motor has committed to increase its investments in electric vehicles to $11 billion by 2022 and to have 40 hybrid and fully electric vehicles in its model lineup. Similarly, in 2019, Volkswagen announced to invest $66.3 billion in the next five years in digitization as well as producing more electric and hybrid vehicles. As electric vehicles require components with advanced technology, automotive valve manufacturers have been investing heavily for developing advanced valves according to the requirement of growing electrification in vehicle. Hence the rising demand for electric vehicles globally drives the automotive valves market.

- Stringent Government Regulations

Government regulations and standards have mandated an increase in fuel efficiency of vehicles, which in turn is driving the global automotive valve market. For instance, Corporate Average Fuel Economy (CAFE) regulations across the globe are prompting automakers to enhance fuel efficiency of their vehicles in the time frame proposed by government and regulatory authorities. Similarly, The National Highway Traffic Safety Administration (NHTSA) and the U.S. Environmental Protection Agency (EPA) have set standards to improve fuel economy and reduce emission gases for passenger cars and light trucks for all new models from 2017. India has also adopted CAFÉ regulations since April 1, 2017 in order to reduce average corporate CO2 emission caused by two-wheelers, three-wheelers, passenger and commercial vehicles. Similar norms are being adopted in several countries including China to reduce fuel consumption in vehicles. As automotive valves are used to increase the fuel efficiency, these stringent regulations are analysed to drive the market in the forecast period 2020-2025.

Challenges – Automotive Valve Market

- Increasing adoption of engine downsizing by OEM's

The rising trend for engine downsizing through use of new technologies is restraining the growth of this market. Several companies have been investing heavily for downsizing the engine. For instance Ford has announced that they will be continuing their quest to downsize their engines without losing performance or affordability. Similarly, Volkswagen has also committed to reduce the size of engine. Hence engine downsizing reduce the usage of valves and hamper the market growth in the forecast period 2020-2025.

Market Landscape

Technology launches, acquisitions, Partnerships and R&D activities are key strategies adopted by players in the Automotive Valve market. In 2019, the market of Automotive Valve industry outlook has been fragmented by several companies. Automotive Valve top 10 companies include Borgwarner Inc., Continental AG,Delphi Automotive PLC, Denso Corporation, Eaton Corporation PLC, Federal Mogul, Johnson Electric Group, Robert Bosch GmbH, Valeo S.A., G&S Valves among others.

Acquisitions/Technology Launches

- In January 2020, Danfoss acquired Eaton’s hydraulics business to focus on strengthening its core business segment such as valves and others.

1. Automotive Valves Market - Overview

1.1 Definitions and Scope

2. Automotive Valves Market - Executive summary

2.1 Market Revenue, Market Size and Key Trends by Company

2.2 Key Trends by type of Application

2.3 Key Trends segmented by Geography

3. Automotive Valves Market

3.1 Comparative analysis

3.1.1 Product Benchmarking - Top 10 companies

3.1.2 Top 5 Financials Analysis

3.1.3 Market Value split by Top 10 companies

3.1.4 Patent Analysis - Top 10 companies

3.1.5 Pricing Analysis

4. Automotive Valves Market - Startup companies Scenario Premium

4.1 Top 10 startup company Analysis by

4.1.1 Investment

4.1.2 Revenue

4.1.3 Market Shares

4.1.4 Market Size and Application Analysis

4.1.5 Venture Capital and Funding Scenario

5. Automotive Valves Market - Industry Market Entry Scenario Premium

5.1 Regulatory Framework Overview

5.2 New Business and Ease of Doing business index

5.3 Case studies of successful ventures

5.4 Customer Analysis - Top 10 companies

6. Automotive Valves Market Forces

6.1 Drivers

6.2 Constraints

6.3 Challenges

6.4 Porters five force model

6.4.1 Bargaining power of suppliers

6.4.2 Bargaining powers of customers

6.4.3 Threat of new entrants

6.4.4 Rivalry among existing players

6.4.5 Threat of substitutes

7. Automotive Valves Market -Strategic analysis

7.1 Value chain analysis

7.2 Opportunities analysis

7.3 Product life cycle

7.4 Suppliers and distributors Market Share

8. Automotive Valves Market - By Product Type (Market Size -$Million / $Billion)

8.1 Market Size and Market Share Analysis

8.2 Application Revenue and Trend Research

8.3 Product Segment Analysis

8.3.1 A/C Valve

8.3.2 Brake Combination Valve

8.3.3 Thermostat Valve

8.3.4 Fuel System Valve

8.3.5 Solenoid Valve

8.3.6 Tire Valve

9. Automotive Valves Market - By Type (Market Size -$Million / $Billion)

9.1 Automotive Valves Market By Function Type

9.1.1 Electric

9.1.2 Hydraulic

9.1.3 Pneumatic

9.1.4 Mechanical

9.1.5 Others

9.2 Automotive Valves Market By Vehicle Type

9.2.1 Passenger Car

9.2.2 Light Commercial Vehicle

9.2.3 Heavy Commercial Vehicle

9.3 Automotive Valves Market By Electric Vehicle Type

9.3.1 Battery Electric Vehicle

9.3.2 Plug-In Hybrid Electric Vehicle

9.3.3 Hybrid Electric Vehicle

10. Automotive Valves - By Application (Market Size -$Million / $Billion)

10.1 Segment type Size and Market Share Analysis

10.2 Application Revenue and Trends by type of Application

10.3 Application Segment Analysis by Type

10.3.1 Engine System

10.3.2 HVAC System

10.3.3 Brake System

10.3.4 Others

11. Automotive Valves- By Geography (Market Size -$Million / $Billion)

11.1 Automotive Valves Market - North America Segment Research

11.2 North America Market Research (Million / $Billion)

11.2.1 Segment type Size and Market Size Analysis

11.2.2 Revenue and Trends

11.2.3 Application Revenue and Trends by type of Application

11.2.4 Company Revenue and Product Analysis

11.2.5 North America Product type and Application Market Size

11.2.5.1 U.S

11.2.5.2 Canada

11.2.5.3 Mexico

11.2.5.4 Rest of North America

11.3 Automotive Valves- South America Segment Research

11.4 South America Market Research (Market Size -$Million / $Billion)

11.4.1 Segment type Size and Market Size Analysis

11.4.2 Revenue and Trends

11.4.3 Application Revenue and Trends by type of Application

11.4.4 Company Revenue and Product Analysis

11.4.5 South America Product type and Application Market Size

11.4.5.1 Brazil

11.4.5.2 Venezuela

11.4.5.3 Argentina

11.4.5.4 Ecuador

11.4.5.5 Peru

11.4.5.6 Colombia

11.4.5.7 Costa Rica

11.4.5.8 Rest of South America

11.5 Automotive Valves- Europe Segment Research

11.6 Europe Market Research (Market Size -$Million / $Billion)

11.6.1 Segment type Size and Market Size Analysis

11.6.2 Revenue and Trends

11.6.3 Application Revenue and Trends by type of Application

11.6.4 Company Revenue and Product Analysis

11.6.5 Europe Segment Product type and Application Market Size

11.6.5.1 U.K

11.6.5.2 Germany

11.6.5.3 Italy

11.6.5.4 France

11.6.5.5 Netherlands

11.6.5.6 Belgium

11.6.5.7 Denmark

11.6.5.8 Spain

11.6.5.9 Rest of Europe

11.7 Automotive Valves - APAC Segment Research

11.8 APAC Market Research (Market Size -$Million / $Billion)

11.8.1 Segment type Size and Market Size Analysis

11.8.2 Revenue and Trends

11.8.3 Application Revenue and Trends by type of Application

11.8.4 Company Revenue and Product Analysis

11.8.5 APAC Segment - Product type and Application Market Size

11.8.5.1 China

11.8.5.2 Australia

11.8.5.3 Japan

11.8.5.4 South Korea

11.8.5.5 India

11.8.5.6 Taiwan

11.8.5.7 Malaysia

11.8.5.8 Hong kong

11.8.5.9 Rest of APAC

11.9 Automotive Valves - Middle East Segment and Africa Segment Research

11.10 Middle East & Africa Market Research (Market Size -$Million / $Billion)

11.10.1 Segment type Size and Market Size Analysis

11.10.2 Revenue and Trend Analysis

11.10.3 Application Revenue and Trends by type of Application

11.10.4 Company Revenue and Product Analysis

11.10.5 Middle East Segment Product type and Application Market Size

11.10.5.1 Israel

11.10.5.2 Saudi Arabia

11.10.5.3 UAE

11.10.6 Africa Segment Analysis

11.10.6.1 South Africa

11.10.6.2 Rest of Middle East & Africa

12. Automotive Valves Market - Entropy

12.1 New product launches

12.2 M&A s, collaborations, JVs and partnerships

13. Automotive Valves Market - Industry / Segment Competition landscape Premium

13.1 Market Share Analysis

13.1.1 Market Share by Country- Top companies

13.1.2 Market Share by Region- Top 10 companies

13.1.3 Market Share by type of Application - Top 10 companies

13.1.4 Market Share by type of Product / Product category- Top 10 companies

13.1.5 Market Share at global level - Top 10 companies

13.1.6 Best Practises for companies

14. Automotive Valves Market - Key Company List by Country Premium

15. Automotive Valves Market Company Analysis

15.1 Market Share, Company Revenue, Products, M&A, Developments

15.2 Borgwarner Inc.

15.3 Continental AG

15.4 Delphi Automotive PLC

15.5 Denso Corporation

15.6 Eaton Corporation PLC

15.7 Federal Mogul

15.8 Johnson Electric Group

15.9 Robert Bosch GmbH

15.10 Valeo S.A.

15.11 Company 11

15.12 Company 12 & More

16.1 Abbreviations

16.2 Sources

17. Automotive Valves Market - Methodology

17.1 Research Methodology

17.1.1 Company Expert Interviews

17.1.2 Industry Databases

17.1.3 Associations

17.1.4 Company News

17.1.5 Company Annual Reports

17.1.6 Application Trends

17.1.7 New Products and Product database

17.1.8 Company Transcripts

17.1.9 R&D Trends

17.1.10 Key Opinion Leaders Interviews

17.1.11 Supply and Demand Trends

1.1 Definitions and Scope

2. Automotive Valves Market - Executive summary

2.1 Market Revenue, Market Size and Key Trends by Company

2.2 Key Trends by type of Application

2.3 Key Trends segmented by Geography

3. Automotive Valves Market

3.1 Comparative analysis

3.1.1 Product Benchmarking - Top 10 companies

3.1.2 Top 5 Financials Analysis

3.1.3 Market Value split by Top 10 companies

3.1.4 Patent Analysis - Top 10 companies

3.1.5 Pricing Analysis

4. Automotive Valves Market - Startup companies Scenario Premium

4.1 Top 10 startup company Analysis by

4.1.1 Investment

4.1.2 Revenue

4.1.3 Market Shares

4.1.4 Market Size and Application Analysis

4.1.5 Venture Capital and Funding Scenario

5. Automotive Valves Market - Industry Market Entry Scenario Premium

5.1 Regulatory Framework Overview

5.2 New Business and Ease of Doing business index

5.3 Case studies of successful ventures

5.4 Customer Analysis - Top 10 companies

6. Automotive Valves Market Forces

6.1 Drivers

6.2 Constraints

6.3 Challenges

6.4 Porters five force model

6.4.1 Bargaining power of suppliers

6.4.2 Bargaining powers of customers

6.4.3 Threat of new entrants

6.4.4 Rivalry among existing players

6.4.5 Threat of substitutes

7. Automotive Valves Market -Strategic analysis

7.1 Value chain analysis

7.2 Opportunities analysis

7.3 Product life cycle

7.4 Suppliers and distributors Market Share

8. Automotive Valves Market - By Product Type (Market Size -$Million / $Billion)

8.1 Market Size and Market Share Analysis

8.2 Application Revenue and Trend Research

8.3 Product Segment Analysis

8.3.1 A/C Valve

8.3.2 Brake Combination Valve

8.3.3 Thermostat Valve

8.3.4 Fuel System Valve

8.3.5 Solenoid Valve

8.3.6 Tire Valve

9. Automotive Valves Market - By Type (Market Size -$Million / $Billion)

9.1 Automotive Valves Market By Function Type

9.1.1 Electric

9.1.2 Hydraulic

9.1.3 Pneumatic

9.1.4 Mechanical

9.1.5 Others

9.2 Automotive Valves Market By Vehicle Type

9.2.1 Passenger Car

9.2.2 Light Commercial Vehicle

9.2.3 Heavy Commercial Vehicle

9.3 Automotive Valves Market By Electric Vehicle Type

9.3.1 Battery Electric Vehicle

9.3.2 Plug-In Hybrid Electric Vehicle

9.3.3 Hybrid Electric Vehicle

10. Automotive Valves - By Application (Market Size -$Million / $Billion)

10.1 Segment type Size and Market Share Analysis

10.2 Application Revenue and Trends by type of Application

10.3 Application Segment Analysis by Type

10.3.1 Engine System

10.3.2 HVAC System

10.3.3 Brake System

10.3.4 Others

11. Automotive Valves- By Geography (Market Size -$Million / $Billion)

11.1 Automotive Valves Market - North America Segment Research

11.2 North America Market Research (Million / $Billion)

11.2.1 Segment type Size and Market Size Analysis

11.2.2 Revenue and Trends

11.2.3 Application Revenue and Trends by type of Application

11.2.4 Company Revenue and Product Analysis

11.2.5 North America Product type and Application Market Size

11.2.5.1 U.S

11.2.5.2 Canada

11.2.5.3 Mexico

11.2.5.4 Rest of North America

11.3 Automotive Valves- South America Segment Research

11.4 South America Market Research (Market Size -$Million / $Billion)

11.4.1 Segment type Size and Market Size Analysis

11.4.2 Revenue and Trends

11.4.3 Application Revenue and Trends by type of Application

11.4.4 Company Revenue and Product Analysis

11.4.5 South America Product type and Application Market Size

11.4.5.1 Brazil

11.4.5.2 Venezuela

11.4.5.3 Argentina

11.4.5.4 Ecuador

11.4.5.5 Peru

11.4.5.6 Colombia

11.4.5.7 Costa Rica

11.4.5.8 Rest of South America

11.5 Automotive Valves- Europe Segment Research

11.6 Europe Market Research (Market Size -$Million / $Billion)

11.6.1 Segment type Size and Market Size Analysis

11.6.2 Revenue and Trends

11.6.3 Application Revenue and Trends by type of Application

11.6.4 Company Revenue and Product Analysis

11.6.5 Europe Segment Product type and Application Market Size

11.6.5.1 U.K

11.6.5.2 Germany

11.6.5.3 Italy

11.6.5.4 France

11.6.5.5 Netherlands

11.6.5.6 Belgium

11.6.5.7 Denmark

11.6.5.8 Spain

11.6.5.9 Rest of Europe

11.7 Automotive Valves - APAC Segment Research

11.8 APAC Market Research (Market Size -$Million / $Billion)

11.8.1 Segment type Size and Market Size Analysis

11.8.2 Revenue and Trends

11.8.3 Application Revenue and Trends by type of Application

11.8.4 Company Revenue and Product Analysis

11.8.5 APAC Segment - Product type and Application Market Size

11.8.5.1 China

11.8.5.2 Australia

11.8.5.3 Japan

11.8.5.4 South Korea

11.8.5.5 India

11.8.5.6 Taiwan

11.8.5.7 Malaysia

11.8.5.8 Hong kong

11.8.5.9 Rest of APAC

11.9 Automotive Valves - Middle East Segment and Africa Segment Research

11.10 Middle East & Africa Market Research (Market Size -$Million / $Billion)

11.10.1 Segment type Size and Market Size Analysis

11.10.2 Revenue and Trend Analysis

11.10.3 Application Revenue and Trends by type of Application

11.10.4 Company Revenue and Product Analysis

11.10.5 Middle East Segment Product type and Application Market Size

11.10.5.1 Israel

11.10.5.2 Saudi Arabia

11.10.5.3 UAE

11.10.6 Africa Segment Analysis

11.10.6.1 South Africa

11.10.6.2 Rest of Middle East & Africa

12. Automotive Valves Market - Entropy

12.1 New product launches

12.2 M&A s, collaborations, JVs and partnerships

13. Automotive Valves Market - Industry / Segment Competition landscape Premium

13.1 Market Share Analysis

13.1.1 Market Share by Country- Top companies

13.1.2 Market Share by Region- Top 10 companies

13.1.3 Market Share by type of Application - Top 10 companies

13.1.4 Market Share by type of Product / Product category- Top 10 companies

13.1.5 Market Share at global level - Top 10 companies

13.1.6 Best Practises for companies

14. Automotive Valves Market - Key Company List by Country Premium

15. Automotive Valves Market Company Analysis

15.1 Market Share, Company Revenue, Products, M&A, Developments

15.2 Borgwarner Inc.

15.3 Continental AG

15.4 Delphi Automotive PLC

15.5 Denso Corporation

15.6 Eaton Corporation PLC

15.7 Federal Mogul

15.8 Johnson Electric Group

15.9 Robert Bosch GmbH

15.10 Valeo S.A.

15.11 Company 11

15.12 Company 12 & More

*Financials would be provided on a best efforts basis for private companies

16. Automotive Valves Market - Appendix16.1 Abbreviations

16.2 Sources

17. Automotive Valves Market - Methodology

17.1 Research Methodology

17.1.1 Company Expert Interviews

17.1.2 Industry Databases

17.1.3 Associations

17.1.4 Company News

17.1.5 Company Annual Reports

17.1.6 Application Trends

17.1.7 New Products and Product database

17.1.8 Company Transcripts

17.1.9 R&D Trends

17.1.10 Key Opinion Leaders Interviews

17.1.11 Supply and Demand Trends

LIST OF TABLES

1.Global Automotive Valves Market By Product Type Market 2019-2024 ($M)1.1 A/C Valve Market 2019-2024 ($M) - Global Industry Research

1.2 Brake Combination Valve Market 2019-2024 ($M) - Global Industry Research

1.3 Thermostat Valve Market 2019-2024 ($M) - Global Industry Research

1.4 Fuel System Valve Market 2019-2024 ($M) - Global Industry Research

1.5 Solenoid Valve Market 2019-2024 ($M) - Global Industry Research

1.6 Tire Valve Market 2019-2024 ($M) - Global Industry Research

2.Global Automotive Valves Market By Function Type Market 2019-2024 ($M)

2.1 Electric Market 2019-2024 ($M) - Global Industry Research

2.2 Hydraulic Market 2019-2024 ($M) - Global Industry Research

2.3 Pneumatic Market 2019-2024 ($M) - Global Industry Research

2.4 Mechanical Market 2019-2024 ($M) - Global Industry Research

3.Global Automotive Valves Market By Vehicle Type Market 2019-2024 ($M)

3.1 Passenger Car Market 2019-2024 ($M) - Global Industry Research

3.2 Light Commercial Vehicle Market 2019-2024 ($M) - Global Industry Research

3.3 Heavy Commercial Vehicle Market 2019-2024 ($M) - Global Industry Research

4.Global Automotive Valves Market By Electric Vehicle Type Market 2019-2024 ($M)

4.1 Battery Electric Vehicle Market 2019-2024 ($M) - Global Industry Research

4.2 Plug-In Hybrid Electric Vehicle Market 2019-2024 ($M) - Global Industry Research

4.3 Hybrid Electric Vehicle Market 2019-2024 ($M) - Global Industry Research

5.Global Automotive Valves Market By Product Type Market 2019-2024 (Volume/Units)

5.1 A/C Valve Market 2019-2024 (Volume/Units) - Global Industry Research

5.2 Brake Combination Valve Market 2019-2024 (Volume/Units) - Global Industry Research

5.3 Thermostat Valve Market 2019-2024 (Volume/Units) - Global Industry Research

5.4 Fuel System Valve Market 2019-2024 (Volume/Units) - Global Industry Research

5.5 Solenoid Valve Market 2019-2024 (Volume/Units) - Global Industry Research

5.6 Tire Valve Market 2019-2024 (Volume/Units) - Global Industry Research

6.Global Automotive Valves Market By Function Type Market 2019-2024 (Volume/Units)

6.1 Electric Market 2019-2024 (Volume/Units) - Global Industry Research

6.2 Hydraulic Market 2019-2024 (Volume/Units) - Global Industry Research

6.3 Pneumatic Market 2019-2024 (Volume/Units) - Global Industry Research

6.4 Mechanical Market 2019-2024 (Volume/Units) - Global Industry Research

7.Global Automotive Valves Market By Vehicle Type Market 2019-2024 (Volume/Units)

7.1 Passenger Car Market 2019-2024 (Volume/Units) - Global Industry Research

7.2 Light Commercial Vehicle Market 2019-2024 (Volume/Units) - Global Industry Research

7.3 Heavy Commercial Vehicle Market 2019-2024 (Volume/Units) - Global Industry Research

8.Global Automotive Valves Market By Electric Vehicle Type Market 2019-2024 (Volume/Units)

8.1 Battery Electric Vehicle Market 2019-2024 (Volume/Units) - Global Industry Research

8.2 Plug-In Hybrid Electric Vehicle Market 2019-2024 (Volume/Units) - Global Industry Research

8.3 Hybrid Electric Vehicle Market 2019-2024 (Volume/Units) - Global Industry Research

9.North America Automotive Valves Market By Product Type Market 2019-2024 ($M)

9.1 A/C Valve Market 2019-2024 ($M) - Regional Industry Research

9.2 Brake Combination Valve Market 2019-2024 ($M) - Regional Industry Research

9.3 Thermostat Valve Market 2019-2024 ($M) - Regional Industry Research

9.4 Fuel System Valve Market 2019-2024 ($M) - Regional Industry Research

9.5 Solenoid Valve Market 2019-2024 ($M) - Regional Industry Research

9.6 Tire Valve Market 2019-2024 ($M) - Regional Industry Research

10.North America Automotive Valves Market By Function Type Market 2019-2024 ($M)

10.1 Electric Market 2019-2024 ($M) - Regional Industry Research

10.2 Hydraulic Market 2019-2024 ($M) - Regional Industry Research

10.3 Pneumatic Market 2019-2024 ($M) - Regional Industry Research

10.4 Mechanical Market 2019-2024 ($M) - Regional Industry Research

11.North America Automotive Valves Market By Vehicle Type Market 2019-2024 ($M)

11.1 Passenger Car Market 2019-2024 ($M) - Regional Industry Research

11.2 Light Commercial Vehicle Market 2019-2024 ($M) - Regional Industry Research

11.3 Heavy Commercial Vehicle Market 2019-2024 ($M) - Regional Industry Research

12.North America Automotive Valves Market By Electric Vehicle Type Market 2019-2024 ($M)

12.1 Battery Electric Vehicle Market 2019-2024 ($M) - Regional Industry Research

12.2 Plug-In Hybrid Electric Vehicle Market 2019-2024 ($M) - Regional Industry Research

12.3 Hybrid Electric Vehicle Market 2019-2024 ($M) - Regional Industry Research

13.South America Automotive Valves Market By Product Type Market 2019-2024 ($M)

13.1 A/C Valve Market 2019-2024 ($M) - Regional Industry Research

13.2 Brake Combination Valve Market 2019-2024 ($M) - Regional Industry Research

13.3 Thermostat Valve Market 2019-2024 ($M) - Regional Industry Research

13.4 Fuel System Valve Market 2019-2024 ($M) - Regional Industry Research

13.5 Solenoid Valve Market 2019-2024 ($M) - Regional Industry Research

13.6 Tire Valve Market 2019-2024 ($M) - Regional Industry Research

14.South America Automotive Valves Market By Function Type Market 2019-2024 ($M)

14.1 Electric Market 2019-2024 ($M) - Regional Industry Research

14.2 Hydraulic Market 2019-2024 ($M) - Regional Industry Research

14.3 Pneumatic Market 2019-2024 ($M) - Regional Industry Research

14.4 Mechanical Market 2019-2024 ($M) - Regional Industry Research

15.South America Automotive Valves Market By Vehicle Type Market 2019-2024 ($M)

15.1 Passenger Car Market 2019-2024 ($M) - Regional Industry Research

15.2 Light Commercial Vehicle Market 2019-2024 ($M) - Regional Industry Research

15.3 Heavy Commercial Vehicle Market 2019-2024 ($M) - Regional Industry Research

16.South America Automotive Valves Market By Electric Vehicle Type Market 2019-2024 ($M)

16.1 Battery Electric Vehicle Market 2019-2024 ($M) - Regional Industry Research

16.2 Plug-In Hybrid Electric Vehicle Market 2019-2024 ($M) - Regional Industry Research

16.3 Hybrid Electric Vehicle Market 2019-2024 ($M) - Regional Industry Research

17.Europe Automotive Valves Market By Product Type Market 2019-2024 ($M)

17.1 A/C Valve Market 2019-2024 ($M) - Regional Industry Research

17.2 Brake Combination Valve Market 2019-2024 ($M) - Regional Industry Research

17.3 Thermostat Valve Market 2019-2024 ($M) - Regional Industry Research

17.4 Fuel System Valve Market 2019-2024 ($M) - Regional Industry Research

17.5 Solenoid Valve Market 2019-2024 ($M) - Regional Industry Research

17.6 Tire Valve Market 2019-2024 ($M) - Regional Industry Research

18.Europe Automotive Valves Market By Function Type Market 2019-2024 ($M)

18.1 Electric Market 2019-2024 ($M) - Regional Industry Research

18.2 Hydraulic Market 2019-2024 ($M) - Regional Industry Research

18.3 Pneumatic Market 2019-2024 ($M) - Regional Industry Research

18.4 Mechanical Market 2019-2024 ($M) - Regional Industry Research

19.Europe Automotive Valves Market By Vehicle Type Market 2019-2024 ($M)

19.1 Passenger Car Market 2019-2024 ($M) - Regional Industry Research

19.2 Light Commercial Vehicle Market 2019-2024 ($M) - Regional Industry Research

19.3 Heavy Commercial Vehicle Market 2019-2024 ($M) - Regional Industry Research

20.Europe Automotive Valves Market By Electric Vehicle Type Market 2019-2024 ($M)

20.1 Battery Electric Vehicle Market 2019-2024 ($M) - Regional Industry Research

20.2 Plug-In Hybrid Electric Vehicle Market 2019-2024 ($M) - Regional Industry Research

20.3 Hybrid Electric Vehicle Market 2019-2024 ($M) - Regional Industry Research

21.APAC Automotive Valves Market By Product Type Market 2019-2024 ($M)

21.1 A/C Valve Market 2019-2024 ($M) - Regional Industry Research

21.2 Brake Combination Valve Market 2019-2024 ($M) - Regional Industry Research

21.3 Thermostat Valve Market 2019-2024 ($M) - Regional Industry Research

21.4 Fuel System Valve Market 2019-2024 ($M) - Regional Industry Research

21.5 Solenoid Valve Market 2019-2024 ($M) - Regional Industry Research

21.6 Tire Valve Market 2019-2024 ($M) - Regional Industry Research

22.APAC Automotive Valves Market By Function Type Market 2019-2024 ($M)

22.1 Electric Market 2019-2024 ($M) - Regional Industry Research

22.2 Hydraulic Market 2019-2024 ($M) - Regional Industry Research

22.3 Pneumatic Market 2019-2024 ($M) - Regional Industry Research

22.4 Mechanical Market 2019-2024 ($M) - Regional Industry Research

23.APAC Automotive Valves Market By Vehicle Type Market 2019-2024 ($M)

23.1 Passenger Car Market 2019-2024 ($M) - Regional Industry Research

23.2 Light Commercial Vehicle Market 2019-2024 ($M) - Regional Industry Research

23.3 Heavy Commercial Vehicle Market 2019-2024 ($M) - Regional Industry Research

24.APAC Automotive Valves Market By Electric Vehicle Type Market 2019-2024 ($M)

24.1 Battery Electric Vehicle Market 2019-2024 ($M) - Regional Industry Research

24.2 Plug-In Hybrid Electric Vehicle Market 2019-2024 ($M) - Regional Industry Research

24.3 Hybrid Electric Vehicle Market 2019-2024 ($M) - Regional Industry Research

25.MENA Automotive Valves Market By Product Type Market 2019-2024 ($M)

25.1 A/C Valve Market 2019-2024 ($M) - Regional Industry Research

25.2 Brake Combination Valve Market 2019-2024 ($M) - Regional Industry Research

25.3 Thermostat Valve Market 2019-2024 ($M) - Regional Industry Research

25.4 Fuel System Valve Market 2019-2024 ($M) - Regional Industry Research

25.5 Solenoid Valve Market 2019-2024 ($M) - Regional Industry Research

25.6 Tire Valve Market 2019-2024 ($M) - Regional Industry Research

26.MENA Automotive Valves Market By Function Type Market 2019-2024 ($M)

26.1 Electric Market 2019-2024 ($M) - Regional Industry Research

26.2 Hydraulic Market 2019-2024 ($M) - Regional Industry Research

26.3 Pneumatic Market 2019-2024 ($M) - Regional Industry Research

26.4 Mechanical Market 2019-2024 ($M) - Regional Industry Research

27.MENA Automotive Valves Market By Vehicle Type Market 2019-2024 ($M)

27.1 Passenger Car Market 2019-2024 ($M) - Regional Industry Research

27.2 Light Commercial Vehicle Market 2019-2024 ($M) - Regional Industry Research

27.3 Heavy Commercial Vehicle Market 2019-2024 ($M) - Regional Industry Research

28.MENA Automotive Valves Market By Electric Vehicle Type Market 2019-2024 ($M)

28.1 Battery Electric Vehicle Market 2019-2024 ($M) - Regional Industry Research

28.2 Plug-In Hybrid Electric Vehicle Market 2019-2024 ($M) - Regional Industry Research

28.3 Hybrid Electric Vehicle Market 2019-2024 ($M) - Regional Industry Research

LIST OF FIGURES

1.US Automotive Valves Market Revenue, 2019-2024 ($M)2.Canada Automotive Valves Market Revenue, 2019-2024 ($M)

3.Mexico Automotive Valves Market Revenue, 2019-2024 ($M)

4.Brazil Automotive Valves Market Revenue, 2019-2024 ($M)

5.Argentina Automotive Valves Market Revenue, 2019-2024 ($M)

6.Peru Automotive Valves Market Revenue, 2019-2024 ($M)

7.Colombia Automotive Valves Market Revenue, 2019-2024 ($M)

8.Chile Automotive Valves Market Revenue, 2019-2024 ($M)

9.Rest of South America Automotive Valves Market Revenue, 2019-2024 ($M)

10.UK Automotive Valves Market Revenue, 2019-2024 ($M)

11.Germany Automotive Valves Market Revenue, 2019-2024 ($M)

12.France Automotive Valves Market Revenue, 2019-2024 ($M)

13.Italy Automotive Valves Market Revenue, 2019-2024 ($M)

14.Spain Automotive Valves Market Revenue, 2019-2024 ($M)

15.Rest of Europe Automotive Valves Market Revenue, 2019-2024 ($M)

16.China Automotive Valves Market Revenue, 2019-2024 ($M)

17.India Automotive Valves Market Revenue, 2019-2024 ($M)

18.Japan Automotive Valves Market Revenue, 2019-2024 ($M)

19.South Korea Automotive Valves Market Revenue, 2019-2024 ($M)

20.South Africa Automotive Valves Market Revenue, 2019-2024 ($M)

21.North America Automotive Valves By Application

22.South America Automotive Valves By Application

23.Europe Automotive Valves By Application

24.APAC Automotive Valves By Application

25.MENA Automotive Valves By Application

26.Continental AG, Sales /Revenue, 2015-2018 ($Mn/$Bn)

27.Delphi Automotive PLC, Sales /Revenue, 2015-2018 ($Mn/$Bn)

28.Denso Corporation, Sales /Revenue, 2015-2018 ($Mn/$Bn)

29.Robert Bosch GmbH, Sales /Revenue, 2015-2018 ($Mn/$Bn)

30.Borgwarner Inc., Sales /Revenue, 2015-2018 ($Mn/$Bn)

31.Valeo S.A., Sales /Revenue, 2015-2018 ($Mn/$Bn)

32.Federal Mogul, Sales /Revenue, 2015-2018 ($Mn/$Bn)

33.Eaton Corporation PLC, Sales /Revenue, 2015-2018 ($Mn/$Bn)

34.Johnson Electric Group, Sales /Revenue, 2015-2018 ($Mn/$Bn)

Email

Email Print

Print