Composites Market Overview

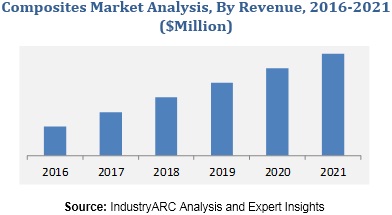

The global composites market revenue was valued at $82,727 million, according to this IndustryARC market research report, with the demand estimated to increment at a positive CAGR of 5.6% during the forecast period of 2019 to 2025. The global composites market size is consistently expanding owing to the infinite applications of composites in numerous end-user industries including construction, industrial, automotive, defense, sports, and aerospace. However, the analyst of the report pinpoints the construction and automotive industries to generate the most prominent chunk of demand.

As per the findings of the report, the construction and infrastructure application segment of the composites market is blooming at an above average CAGR of 6.3% through to 2025. The analyst attributes this to urbanization across both developed and developing economies. According to the World Bank Group, the International Financial Corporation (IFC) estimates investment opportunity of $16 trillion by 2030 exists for the development of green buildings in Paris. Over in Asia Pacific, Chinese and Indian building and construction industry players are leveraging new techniques of prefabricated prefinished volumetric construction (PPVC), 3D printing, and new materials thanks to composites. With such an influx in the global construction industry, the composites market is expected to grow consequently. On the back of expansive landscapes and massive population, the Asia-Pacific region is projected to dominate the global composites market, seizing 37% of the total demand share.

Composites Market: Product Attributes

Engineers and designers across the world recognize the capability of composite materials to produce durable, cost-effective, and high-quality products. Composites raise performance levels and supports the development of innovative products. Composites are materials manufactured by combining two or more types of artificial or natural elements with the same or varying chemical properties. The process of mixing these two elements makes the final composite much stronger and flexible than individual products. These composites are often referred to as alloys or fiber reinforced plastic (FRP). To manufacture these composites, composite particles such as polyacrylonitrile among other polymers go through various processes such as thermosetting, filament winding process, pultrusion process, and compression molding process. The final products achieved from these processes are fiberglass, carbon fiber, and carbon fiber reinforced plastics (CFRP).

The Composites Market in Construction and Infrastructure Industry

The construction and infrastructure industry is the prime consumer of composites. With construction happening at a rapid pace, the composite market is supposedly expected to reach its apex. The incessant construction of buildings, swimming pools, storage tanks, countertops, bridges, skyscrapers, and commercial landscapes throughout the developed and developing economies is augmenting the growth in the composite market. The emergence of achieving the most durable and lightweight structures has raised the level of engagement of composites in the construction industry. The humungous demands for composites are seen from the APAC region owing to the high speeded construction in developing economies such as India and China.

The Composites Market in Automotive and Aerospace Industry

Fiber-reinforced composite materials have propelled despite their high cost mainly because of the requirements of high-performance products such as aerospace components including wings, tails, propellers, fuselages, helicopter rotor blades, spacecraft equipment. The Airbus A350 and Boeing 787 aircraft components are majorly manufactured using composites. They are also used in the manufacturing of boats, fishing equipment, kayaks, dinghies, and scull hulls. Additionally, among land vehicles, composites are used for the production of cars, bikes, and cycles. The eminent thrill of speed in various sports cars is achieved using durable and lightweight composite materials such as carbon fiber. The chassis of numerous two-wheelers and cycles are manufactured using composites. The emerging electrification among vehicles to replace conventional fuel has immensely increased the employment of composites in the automotive market. The global awareness to tackle carbon emissions is booming the electric vehicle industry, which in turn has resulted in growth in the composite market.

The Composites Market in Textile and Apparel Industry

The textile industry saw the innovation of nylon wearables. These wearables were developed to serve the purpose of being water resistant which means, the water will not penetrate the nylon cloth, but the downside of that garment was that it does not let water vapor pass through the cloth.

This suffocated the garment and the sweat kept getting trapped inside. After wearing these garments for a while these clothes got wet and execrable to wear. To overcome this disadvantage, breathable fabrics were discovered. Breathable clothes are a result of composite materials. These clothes are water resistant and breathable at the same time, which means that the sweat will evaporate from the fabric. The most recent innovation in the breathable clothing market was seen from MIT Media Lab, they have developed moisture and heat responsive gym wear. This garment is a product of composites developed from combining bacterial e.coli cells with latex which resulted in this biofabric. These gears have ventilating flaps that react to the heat and sweat of the person wearing it. The application of composites in the wearable section also lies in the production of firefighting armor. Traits such as fire resistant and light-weighted architecture has induced the usage of composites in this sector.

The Composites Market in Sports Industry

Seven out of ten most popular outdoor games today are using composites as the major raw material to manufacture sports equipment. Sports industry extensively uses the composites for the production of multiple sporting equipment. Manufacturing of baseball bats, tennis, badminton and squash racquets, fishing rods, hockey sticks, and helmets is responsible for the growth of the composites market.

Composites are materials manufactured by combining two or more types of artificial or natural elements with the same or varying chemical properties. The composites market size is mounting owing to the countless applications of composites in various end-user industries such as construction, industrial, automotive, defense, sports, and aerospace industry. The construction and infrastructure industry is the biggest consumer of composites. Also, the automobile industry is stroking the composites market. Breathable clothes are a result of composite materials. Moreover, sports industry extensively uses the composites for the production of multiple sporting equipment. The market outlook is foreseeing the strongest future in the APAC region.

1. Composites Market Overview

2. Executive Summary

3. Composites Market Landscape

3.1. Market Share Analysis

3.2. Comparative Analysis

3.2.1. Product Benchmarking

3.2.2. End User profiling

3.2.3. Patent Analysis

3.2.4. Top 5 Financials Analysis

4. Composites Market Forces

4.1. Market Drivers

4.2. Market Constraints

4.3. Market Challenges

4.4. Attractiveness of the Industry

4.4.1. Power of Suppliers

4.4.2. Power of Customers

4.4.3. Threat of New entrants

4.4.4. Threat of Substitution

4.4.5. Degree of Competition

5. Composites Market – Strategic Analysis

5.1. Value Chain Analysis

5.2. Pricing Analysis

5.3. Opportunities Analysis

5.4. Product/Market Life Cycle Analysis

5.5. Suppliers and Distributors

6. Composites Market - By Type

6.1. Introduction

6.2. Polymers

6.3. Metal

6.3.1. Titanium

6.3.2. Magnesium

6.3.3. Aluminum

6.3.4. Others

6.4. Carbon

6.5. Graphite

6.6. Others

7. Composites Market – By Reinforcement

7.10 Introduction

7.11 Fibers

7.11.1 Natural

7.11.1.1 Animal

7.11.1.2 Vegetable

7.11.1.3 Mineral

7.11.2 Advanced

7.11.2.1 Glass

7.11.2.2 Carbon

7.11.2.3 Organic

7.11.2.4 Ceramic

7.12 Filled

7.13 Whiskers

7.14 Flake

7.15 Particulates

7.16 Others

8. Composites Market – By Resin Types

8.10 Introduction

8.10.1 Thermoplastic

8.10.1.1 Polyethylene

8.10.1.2 Polystyrene

8.10.1.3 Polyamides

8.10.1.4 Nylon

8.10.1.5 Polypropylene

8.10.1.6 Others

8.10.2 Thermoset

8.10.2.1 Epoxy

8.10.2.2 Polyester

8.10.2.3 Phenolic Polyamide

8.10.2.4 Others

9. Composites Market - By Additive & Fillers

9.10 Introduction

9.11 Additives

9.11.1 Pigments & Colorants

9.11.2 Fire Retardants

9.11.3 Suppressants

9.11.4 UV Inhibitors & Stabilizers

9.11.5 Release Agents

9.11.6 Others

9.12 Initiators, Promoters & Inhibitors

9.13 Fillers

9.14 Others

10. Composites Market - By Technology

10.10 Introduction

10.11 Injection Molding

10.12 Compression Molding

10.13 Pultrusion

10.14 Filament Winding

10.15 Layup

11. Composites Market - By End User

11.10 Introduction

11.11 Appliance

11.11.1 Cooking

11.11.2 Dishwasher

11.11.3 Refrigerator

11.11.4 Small Appliances

11.11.5 Laundry

11.11.6 Ice Machines

11.11.7 Others

11.12 Electrical Distribution

11.12.1 Circuit Breakers

11.12.2 Motor Control

11.12.3 Centers

11.12.4 Generators

11.12.5 Switchgear

11.12.6 Busway

11.12.7 Control Cabinets

11.12.8 Cross Arms

11.12.9 Others

11.13 Energy

11.13.1 Wind Turbine

11.13.2 Fuel Cells

11.13.3 Solar Panels

11.13.4 Pumps

11.13.5 Others

11.14 Transportation

11.14.1 Resisters

11.14.2 Drive Motors

11.14.3 Controls

11.14.4 Valve Covers

11.14.5 Oil Pans

11.14.6 Air Suspensions

11.14.7 Others

11.15 Sanitary/Plumbing

11.15.1 Faucets

11.15.2 Sinks

11.15.3 Drains

11.15.4 Showers

11.15.5 Bathtubs

11.15.6 Others

11.16 Marine

11.16.1 Engine Covers

11.16.2 Personal Watercraft

11.16.3 Boat Access Covers

11.16.4 Electrical Buyers

11.16.5 Motor Housing

11.16.6 Others

11.17 HVAC

11.17.1 Drain Pans

11.17.2 Blower Housing

11.17.3 Wall Sleeves

11.17.4 Control Panels

11.17.5 Recreational Vehicles

11.17.6 Others

11.18 Forward Lighting

11.18.1 Headlamps

11.18.2 Reflections

11.18.3 Others

11.19 Aerospace

11.19.1 Aircraft

11.19.2 Military

11.19.3 Spacecraft

11.19.4 Electronics

11.20 Defense

11.21 Automotive

11.22 Railways

11.23 Construction

11.23.1 Infrastructure

11.23.2 Pipes

11.23.3 Structural

11.23.4 Buildings

11.23.5 Bridges

11.23.6 Others

11.24 Biomedical

11.24.1 Prosthetic Devices

11.24.2 Artificial Limbs

11.24.3 Others

11.25 Sporting

11.25.1 Rackets

11.25.2 Golf

11.25.3 Bicycles

11.25.4 Others

11.26 Oil & Gas

11.27 Renewable Energy

11.28 Others

12. Composites Market - By Geography

12.10 North America

12.10.1 U.S.

12.10.2 Canada

12.10.3 Mexico

12.10.4 Rest of North America

12.11 South America

12.11.1 Brazil

12.11.2 Venezuela

12.11.3 Argentina

12.11.4 Ecuador

12.11.5 Peru

12.11.6 Colombia

12.11.7 Costa Rica

12.11.8 Rest of South America

12.12 Europe

12.12.1 U.K

12.12.2 Germany

12.12.3 Italy

12.12.4 France

12.12.5 Netherlands

12.12.6 Belgium

12.12.7 Spain

12.12.8 Denmark

12.12.9 Rest of Europe

12.13 APAC

12.13.1 China

12.13.2 Australia

12.13.3 South Korea

12.13.4 India

12.13.5 Taiwan

12.13.6 Malaysia

12.13.7 Hong Kong

12.13.8 Rest of APAC

12.14 Middle East& Africa

12.14.1 Israel

12.14.2 South Africa

12.14.3 Saudi Arabia

12.14.4 Rest of Middle East and Africa

13. Market Entropy

13.10.1 New Product Launches

13.10.2 M&As, Collaborations, JVs, Partnership

14. Company Profiles (Overview, Financials, SWOT Analysis, Developments, Product Portfolio)

14.10.1 Toray

14.10.2 Tejin

14.10.3 MRC

14.10.4 SGL

14.10.5 Hexel

14.10.6 Cytec (Solvey)

14.10.7 Company 7

14.10.8 Company 8

14.10.9 Company 9

14.10.10 Company 10

*More than 10 Companies are profiled in this Research Report*

"*Financials would be provided on a best efforts basis for private companies"

15 Appendix

15.10.1 Abbreviations

15.10.2 Sources

15.10.3 Research Methodology

15.10.4 Bibliography

15.10.5 Compilation of Expert Insights

15.10.6 Disclaimer

List of Tables:

Table 1: Composites Market Overview 2021-2026

Table 2: Composites Market Leader Analysis 2018-2019 (US$)

Table 3: Composites Market Product Analysis 2018-2019 (US$)

Table 4: Composites Market End User Analysis 2018-2019 (US$)

Table 5: Composites Market Patent Analysis 2013-2018* (US$)

Table 6: Composites Market Financial Analysis 2018-2019 (US$)

Table 7: Composites Market Driver Analysis 2018-2019 (US$)

Table 8: Composites Market Challenges Analysis 2018-2019 (US$)

Table 9: Composites Market Constraint Analysis 2018-2019 (US$)

Table 10: Composites Market Supplier Bargaining Power Analysis 2018-2019 (US$)

Table 11: Composites Market Buyer Bargaining Power Analysis 2018-2019 (US$)

Table 12: Composites Market Threat of Substitutes Analysis 2018-2019 (US$)

Table 13: Composites Market Threat of New Entrants Analysis 2018-2019 (US$)

Table 14: Composites Market Degree of Competition Analysis 2018-2019 (US$)

Table 15: Composites Market Value Chain Analysis 2018-2019 (US$)

Table 16: Composites Market Pricing Analysis 2021-2026 (US$)

Table 17: Composites Market Opportunities Analysis 2021-2026 (US$)

Table 18: Composites Market Product Life Cycle Analysis 2021-2026 (US$)

Table 19: Composites Market Supplier Analysis 2018-2019 (US$)

Table 20: Composites Market Distributor Analysis 2018-2019 (US$)

Table 21: Composites Market Trend Analysis 2018-2019 (US$)

Table 22: Composites Market Size 2018 (US$)

Table 23: Composites Market Forecast Analysis 2021-2026 (US$)

Table 24: Composites Market Sales Forecast Analysis 2021-2026 (Units)

Table 25: Composites Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 26: Composites Market By Type, Revenue & Volume, By Polymers, 2021-2026 ($)

Table 27: Composites Market By Type, Revenue & Volume, By Metal, 2021-2026 ($)

Table 28: Composites Market By Type, Revenue & Volume, By Carbon, 2021-2026 ($)

Table 29: Composites Market By Type, Revenue & Volume, By Graphite, 2021-2026 ($)

Table 30: Composites Market, Revenue & Volume, By Reinforcement, 2021-2026 ($)

Table 31: Composites Market By Reinforcement, Revenue & Volume, By Fibers, 2021-2026 ($)

Table 32: Composites Market By Reinforcement, Revenue & Volume, By Filled, 2021-2026 ($)

Table 33: Composites Market By Reinforcement, Revenue & Volume, By Whiskers, 2021-2026 ($)

Table 34: Composites Market By Reinforcement, Revenue & Volume, By Flake, 2021-2026 ($)

Table 35: Composites Market By Reinforcement, Revenue & Volume, By Particulates, 2021-2026 ($)

Table 36: Composites Market, Revenue & Volume, By Technology, 2021-2026 ($)

Table 37: Composites Market By Technology, Revenue & Volume, By Injection Molding, 2021-2026 ($)

Table 38: Composites Market By Technology, Revenue & Volume, By Compression Molding, 2021-2026 ($)

Table 39: Composites Market By Technology, Revenue & Volume, By Pultrusion, 2021-2026 ($)

Table 40: Composites Market By Technology, Revenue & Volume, By Filament Winding, 2021-2026 ($)

Table 41: Composites Market By Technology, Revenue & Volume, By Layup, 2021-2026 ($)

Table 42: Composites Market, Revenue & Volume, By Additive & Fillers, 2021-2026 ($)

Table 43: Composites Market By Additive & Fillers, Revenue & Volume, By Additives, 2021-2026 ($)

Table 44: Composites Market By Additive & Fillers, Revenue & Volume, By Initiators, Promoters & Inhibitors, 2021-2026 ($)

Table 45: Composites Market By Additive & Fillers, Revenue & Volume, By Fillers, 2021-2026 ($)

Table 46: Composites Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 47: Composites Market By End User, Revenue & Volume, By Appliance, 2021-2026 ($)

Table 48: Composites Market By End User, Revenue & Volume, By Electrical Distribution, 2021-2026 ($)

Table 49: Composites Market By End User, Revenue & Volume, By Energy, 2021-2026 ($)

Table 50: Composites Market By End User, Revenue & Volume, By Transportation, 2021-2026 ($)

Table 51: Composites Market By End User, Revenue & Volume, By Sanitary/Plumbing, 2021-2026 ($)

Table 52: North America Composites Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 53: North America Composites Market, Revenue & Volume, By Reinforcement, 2021-2026 ($)

Table 54: North America Composites Market, Revenue & Volume, By Technology, 2021-2026 ($)

Table 55: North America Composites Market, Revenue & Volume, By Additive & Fillers, 2021-2026 ($)

Table 56: North America Composites Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 57: South america Composites Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 58: South america Composites Market, Revenue & Volume, By Reinforcement, 2021-2026 ($)

Table 59: South america Composites Market, Revenue & Volume, By Technology, 2021-2026 ($)

Table 60: South america Composites Market, Revenue & Volume, By Additive & Fillers, 2021-2026 ($)

Table 61: South america Composites Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 62: Europe Composites Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 63: Europe Composites Market, Revenue & Volume, By Reinforcement, 2021-2026 ($)

Table 64: Europe Composites Market, Revenue & Volume, By Technology, 2021-2026 ($)

Table 65: Europe Composites Market, Revenue & Volume, By Additive & Fillers, 2021-2026 ($)

Table 66: Europe Composites Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 67: APAC Composites Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 68: APAC Composites Market, Revenue & Volume, By Reinforcement, 2021-2026 ($)

Table 69: APAC Composites Market, Revenue & Volume, By Technology, 2021-2026 ($)

Table 70: APAC Composites Market, Revenue & Volume, By Additive & Fillers, 2021-2026 ($)

Table 71: APAC Composites Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 72: Middle East & Africa Composites Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 73: Middle East & Africa Composites Market, Revenue & Volume, By Reinforcement, 2021-2026 ($)

Table 74: Middle East & Africa Composites Market, Revenue & Volume, By Technology, 2021-2026 ($)

Table 75: Middle East & Africa Composites Market, Revenue & Volume, By Additive & Fillers, 2021-2026 ($)

Table 76: Middle East & Africa Composites Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 77: Russia Composites Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 78: Russia Composites Market, Revenue & Volume, By Reinforcement, 2021-2026 ($)

Table 79: Russia Composites Market, Revenue & Volume, By Technology, 2021-2026 ($)

Table 80: Russia Composites Market, Revenue & Volume, By Additive & Fillers, 2021-2026 ($)

Table 81: Russia Composites Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 82: Israel Composites Market, Revenue & Volume, By Type, 2021-2026 ($)

Table 83: Israel Composites Market, Revenue & Volume, By Reinforcement, 2021-2026 ($)

Table 84: Israel Composites Market, Revenue & Volume, By Technology, 2021-2026 ($)

Table 85: Israel Composites Market, Revenue & Volume, By Additive & Fillers, 2021-2026 ($)

Table 86: Israel Composites Market, Revenue & Volume, By End User, 2021-2026 ($)

Table 87: Top Companies 2018 (US$) Composites Market, Revenue & Volume

Table 88: Product Launch 2018-2019 Composites Market, Revenue & Volume

Table 89: Mergers & Acquistions 2018-2019 Composites Market, Revenue & Volume

List of Figures:

Figure 1: Overview of Composites Market 2021-2026

Figure 2: Market Share Analysis for Composites Market 2018 (US$)

Figure 3: Product Comparison in Composites Market 2018-2019 (US$)

Figure 4: End User Profile for Composites Market 2018-2019 (US$)

Figure 5: Patent Application and Grant in Composites Market 2013-2018* (US$)

Figure 6: Top 5 Companies Financial Analysis in Composites Market 2018-2019 (US$)

Figure 7: Market Entry Strategy in Composites Market 2018-2019

Figure 8: Ecosystem Analysis in Composites Market 2018

Figure 9: Average Selling Price in Composites Market 2021-2026

Figure 10: Top Opportunites in Composites Market 2018-2019

Figure 11: Market Life Cycle Analysis in Composites Market

Figure 12: GlobalBy Type Composites Market Revenue, 2021-2026 ($)

Figure 13: GlobalBy Reinforcement Composites Market Revenue, 2021-2026 ($)

Figure 14: GlobalBy Technology Composites Market Revenue, 2021-2026 ($)

Figure 15: GlobalBy Additive & Fillers Composites Market Revenue, 2021-2026 ($)

Figure 16: GlobalBy End User Composites Market Revenue, 2021-2026 ($)

Figure 17: Global Composites Market - By Geography

Figure 18: Global Composites Market Value & Volume, By Geography, 2021-2026 ($)

Figure 19: Global Composites Market CAGR, By Geography, 2021-2026 (%)

Figure 20: North America Composites Market Value & Volume, 2021-2026 ($)

Figure 21: US Composites Market Value & Volume, 2021-2026 ($)

Figure 22: US GDP and Population, 2018-2019 ($)

Figure 23: US GDP – Composition of 2018, By Sector of Origin

Figure 24: US Export and Import Value & Volume, 2018-2019 ($)

Figure 25: Canada Composites Market Value & Volume, 2021-2026 ($)

Figure 26: Canada GDP and Population, 2018-2019 ($)

Figure 27: Canada GDP – Composition of 2018, By Sector of Origin

Figure 28: Canada Export and Import Value & Volume, 2018-2019 ($)

Figure 29: Mexico Composites Market Value & Volume, 2021-2026 ($)

Figure 30: Mexico GDP and Population, 2018-2019 ($)

Figure 31: Mexico GDP – Composition of 2018, By Sector of Origin

Figure 32: Mexico Export and Import Value & Volume, 2018-2019 ($)

Figure 33: South America Composites Market Value & Volume, 2021-2026 ($)

Figure 34: Brazil Composites Market Value & Volume, 2021-2026 ($)

Figure 35: Brazil GDP and Population, 2018-2019 ($)

Figure 36: Brazil GDP – Composition of 2018, By Sector of Origin

Figure 37: Brazil Export and Import Value & Volume, 2018-2019 ($)

Figure 38: Venezuela Composites Market Value & Volume, 2021-2026 ($)

Figure 39: Venezuela GDP and Population, 2018-2019 ($)

Figure 40: Venezuela GDP – Composition of 2018, By Sector of Origin

Figure 41: Venezuela Export and Import Value & Volume, 2018-2019 ($)

Figure 42: Argentina Composites Market Value & Volume, 2021-2026 ($)

Figure 43: Argentina GDP and Population, 2018-2019 ($)

Figure 44: Argentina GDP – Composition of 2018, By Sector of Origin

Figure 45: Argentina Export and Import Value & Volume, 2018-2019 ($)

Figure 46: Ecuador Composites Market Value & Volume, 2021-2026 ($)

Figure 47: Ecuador GDP and Population, 2018-2019 ($)

Figure 48: Ecuador GDP – Composition of 2018, By Sector of Origin

Figure 49: Ecuador Export and Import Value & Volume, 2018-2019 ($)

Figure 50: Peru Composites Market Value & Volume, 2021-2026 ($)

Figure 51: Peru GDP and Population, 2018-2019 ($)

Figure 52: Peru GDP – Composition of 2018, By Sector of Origin

Figure 53: Peru Export and Import Value & Volume, 2018-2019 ($)

Figure 54: Colombia Composites Market Value & Volume, 2021-2026 ($)

Figure 55: Colombia GDP and Population, 2018-2019 ($)

Figure 56: Colombia GDP – Composition of 2018, By Sector of Origin

Figure 57: Colombia Export and Import Value & Volume, 2018-2019 ($)

Figure 58: Costa Rica Composites Market Value & Volume, 2021-2026 ($)

Figure 59: Costa Rica GDP and Population, 2018-2019 ($)

Figure 60: Costa Rica GDP – Composition of 2018, By Sector of Origin

Figure 61: Costa Rica Export and Import Value & Volume, 2018-2019 ($)

Figure 62: Europe Composites Market Value & Volume, 2021-2026 ($)

Figure 63: U.K Composites Market Value & Volume, 2021-2026 ($)

Figure 64: U.K GDP and Population, 2018-2019 ($)

Figure 65: U.K GDP – Composition of 2018, By Sector of Origin

Figure 66: U.K Export and Import Value & Volume, 2018-2019 ($)

Figure 67: Germany Composites Market Value & Volume, 2021-2026 ($)

Figure 68: Germany GDP and Population, 2018-2019 ($)

Figure 69: Germany GDP – Composition of 2018, By Sector of Origin

Figure 70: Germany Export and Import Value & Volume, 2018-2019 ($)

Figure 71: Italy Composites Market Value & Volume, 2021-2026 ($)

Figure 72: Italy GDP and Population, 2018-2019 ($)

Figure 73: Italy GDP – Composition of 2018, By Sector of Origin

Figure 74: Italy Export and Import Value & Volume, 2018-2019 ($)

Figure 75: France Composites Market Value & Volume, 2021-2026 ($)

Figure 76: France GDP and Population, 2018-2019 ($)

Figure 77: France GDP – Composition of 2018, By Sector of Origin

Figure 78: France Export and Import Value & Volume, 2018-2019 ($)

Figure 79: Netherlands Composites Market Value & Volume, 2021-2026 ($)

Figure 80: Netherlands GDP and Population, 2018-2019 ($)

Figure 81: Netherlands GDP – Composition of 2018, By Sector of Origin

Figure 82: Netherlands Export and Import Value & Volume, 2018-2019 ($)

Figure 83: Belgium Composites Market Value & Volume, 2021-2026 ($)

Figure 84: Belgium GDP and Population, 2018-2019 ($)

Figure 85: Belgium GDP – Composition of 2018, By Sector of Origin

Figure 86: Belgium Export and Import Value & Volume, 2018-2019 ($)

Figure 87: Spain Composites Market Value & Volume, 2021-2026 ($)

Figure 88: Spain GDP and Population, 2018-2019 ($)

Figure 89: Spain GDP – Composition of 2018, By Sector of Origin

Figure 90: Spain Export and Import Value & Volume, 2018-2019 ($)

Figure 91: Denmark Composites Market Value & Volume, 2021-2026 ($)

Figure 92: Denmark GDP and Population, 2018-2019 ($)

Figure 93: Denmark GDP – Composition of 2018, By Sector of Origin

Figure 94: Denmark Export and Import Value & Volume, 2018-2019 ($)

Figure 95: APAC Composites Market Value & Volume, 2021-2026 ($)

Figure 96: China Composites Market Value & Volume, 2021-2026

Figure 97: China GDP and Population, 2018-2019 ($)

Figure 98: China GDP – Composition of 2018, By Sector of Origin

Figure 99: China Export and Import Value & Volume, 2018-2019 ($) Composites Market China Export and Import Value & Volume, 2018-2019 ($)

Figure 100: Australia Composites Market Value & Volume, 2021-2026 ($)

Figure 101: Australia GDP and Population, 2018-2019 ($)

Figure 102: Australia GDP – Composition of 2018, By Sector of Origin

Figure 103: Australia Export and Import Value & Volume, 2018-2019 ($)

Figure 104: South Korea Composites Market Value & Volume, 2021-2026 ($)

Figure 105: South Korea GDP and Population, 2018-2019 ($)

Figure 106: South Korea GDP – Composition of 2018, By Sector of Origin

Figure 107: South Korea Export and Import Value & Volume, 2018-2019 ($)

Figure 108: India Composites Market Value & Volume, 2021-2026 ($)

Figure 109: India GDP and Population, 2018-2019 ($)

Figure 110: India GDP – Composition of 2018, By Sector of Origin

Figure 111: India Export and Import Value & Volume, 2018-2019 ($)

Figure 112: Taiwan Composites Market Value & Volume, 2021-2026 ($)

Figure 113: Taiwan GDP and Population, 2018-2019 ($)

Figure 114: Taiwan GDP – Composition of 2018, By Sector of Origin

Figure 115: Taiwan Export and Import Value & Volume, 2018-2019 ($)

Figure 116: Malaysia Composites Market Value & Volume, 2021-2026 ($)

Figure 117: Malaysia GDP and Population, 2018-2019 ($)

Figure 118: Malaysia GDP – Composition of 2018, By Sector of Origin

Figure 119: Malaysia Export and Import Value & Volume, 2018-2019 ($)

Figure 120: Hong Kong Composites Market Value & Volume, 2021-2026 ($)

Figure 121: Hong Kong GDP and Population, 2018-2019 ($)

Figure 122: Hong Kong GDP – Composition of 2018, By Sector of Origin

Figure 123: Hong Kong Export and Import Value & Volume, 2018-2019 ($)

Figure 124: Middle East & Africa Composites Market Middle East & Africa 3D Printing Market Value & Volume, 2021-2026 ($)

Figure 125: Russia Composites Market Value & Volume, 2021-2026 ($)

Figure 126: Russia GDP and Population, 2018-2019 ($)

Figure 127: Russia GDP – Composition of 2018, By Sector of Origin

Figure 128: Russia Export and Import Value & Volume, 2018-2019 ($)

Figure 129: Israel Composites Market Value & Volume, 2021-2026 ($)

Figure 130: Israel GDP and Population, 2018-2019 ($)

Figure 131: Israel GDP – Composition of 2018, By Sector of Origin

Figure 132: Israel Export and Import Value & Volume, 2018-2019 ($)

Figure 133: Entropy Share, By Strategies, 2018-2019* (%) Composites Market

Figure 134: Developments, 2018-2019* Composites Market

Figure 135: Company 1 Composites Market Net Revenue, By Years, 2018-2019* ($)

Figure 136: Company 1 Composites Market Net Revenue Share, By Business segments, 2018 (%)

Figure 137: Company 1 Composites Market Net Sales Share, By Geography, 2018 (%)

Figure 138: Company 2 Composites Market Net Revenue, By Years, 2018-2019* ($)

Figure 139: Company 2 Composites Market Net Revenue Share, By Business segments, 2018 (%)

Figure 140: Company 2 Composites Market Net Sales Share, By Geography, 2018 (%)

Figure 141: Company 3 Composites Market Net Revenue, By Years, 2018-2019* ($)

Figure 142: Company 3 Composites Market Net Revenue Share, By Business segments, 2018 (%)

Figure 143: Company 3 Composites Market Net Sales Share, By Geography, 2018 (%)

Figure 144: Company 4 Composites Market Net Revenue, By Years, 2018-2019* ($)

Figure 145: Company 4 Composites Market Net Revenue Share, By Business segments, 2018 (%)

Figure 146: Company 4 Composites Market Net Sales Share, By Geography, 2018 (%)

Figure 147: Company 5 Composites Market Net Revenue, By Years, 2018-2019* ($)

Figure 148: Company 5 Composites Market Net Revenue Share, By Business segments, 2018 (%)

Figure 149: Company 5 Composites Market Net Sales Share, By Geography, 2018 (%)

Figure 150: Company 6 Composites Market Net Revenue, By Years, 2018-2019* ($)

Figure 151: Company 6 Composites Market Net Revenue Share, By Business segments, 2018 (%)

Figure 152: Company 6 Composites Market Net Sales Share, By Geography, 2018 (%)

Figure 153: Company 7 Composites Market Net Revenue, By Years, 2018-2019* ($)

Figure 154: Company 7 Composites Market Net Revenue Share, By Business segments, 2018 (%)

Figure 155: Company 7 Composites Market Net Sales Share, By Geography, 2018 (%)

Figure 156: Company 8 Composites Market Net Revenue, By Years, 2018-2019* ($)

Figure 157: Company 8 Composites Market Net Revenue Share, By Business segments, 2018 (%)

Figure 158: Company 8 Composites Market Net Sales Share, By Geography, 2018 (%)

Figure 159: Company 9 Composites Market Net Revenue, By Years, 2018-2019* ($)

Figure 160: Company 9 Composites Market Net Revenue Share, By Business segments, 2018 (%)

Figure 161: Company 9 Composites Market Net Sales Share, By Geography, 2018 (%)

Figure 162: Company 10 Composites Market Net Revenue, By Years, 2018-2019* ($)

Figure 163: Company 10 Composites Market Net Revenue Share, By Business segments, 2018 (%)

Figure 164: Company 10 Composites Market Net Sales Share, By Geography, 2018 (%)

Figure 165: Company 11 Composites Market Net Revenue, By Years, 2018-2019* ($)

Figure 166: Company 11 Composites Market Net Revenue Share, By Business segments, 2018 (%)

Figure 167: Company 11 Composites Market Net Sales Share, By Geography, 2018 (%)

Figure 168: Company 12 Composites Market Net Revenue, By Years, 2018-2019* ($)

Figure 169: Company 12 Composites Market Net Revenue Share, By Business segments, 2018 (%)

Figure 170: Company 12 Composites Market Net Sales Share, By Geography, 2018 (%)

Figure 171: Company 13 Composites Market Net Revenue, By Years, 2018-2019* ($)

Figure 172: Company 13 Composites Market Net Revenue Share, By Business segments, 2018 (%)

Figure 173: Company 13 Composites Market Net Sales Share, By Geography, 2018 (%)

Figure 174: Company 14 Composites Market Net Revenue, By Years, 2018-2019* ($)

Figure 175: Company 14 Composites Market Net Revenue Share, By Business segments, 2018 (%)

Figure 176: Company 14 Composites Market Net Sales Share, By Geography, 2018 (%)

Figure 177: Company 15 Composites Market Net Revenue, By Years, 2018-2019* ($)

Figure 178: Company 15 Composites Market Net Revenue Share, By Business segments, 2018 (%)

Figure 179: Company 15 Composites Market Net Sales Share, By Geography, 2018 (%)

Email

Email Print

Print